If you're only thinking about holding onto a rental home for a short amount of time with capital in mind, you'll require to focus your search on areas where it's still cheap to purchase a home. You'll desire to make certain that the lease in these locations is high enough that you can create an earnings that makes it worth it. Prior to you buy, it's important to look into the community's average market lease. Compare that rental quantity to the purchase price, and crunch your numbers. Mynd can assist you compute how much lease to charge. How do you get your real estate license. You also want to look at job rates since that will impact your capital.

Buy a home in a market that has high tenancy rates. That will translate to lower vacancy, so you'll have a simple time developing positive money circulation. An uninhabited residential or commercial property doesn't generate any rent. Not only are you losing rent, however you're also paying to keep your house up and losing cash on energies, landscaping expenses, and other costs. You're not relying on appreciation as a short-term investor, so you can not invest in a rental house that's likely to stay empty. When you're sourcing potential financial investment homes, don't forget to compute your maintenance costs. You don't wish to purchase a residential or commercial property that has a 15-year-old HEATING AND COOLING.

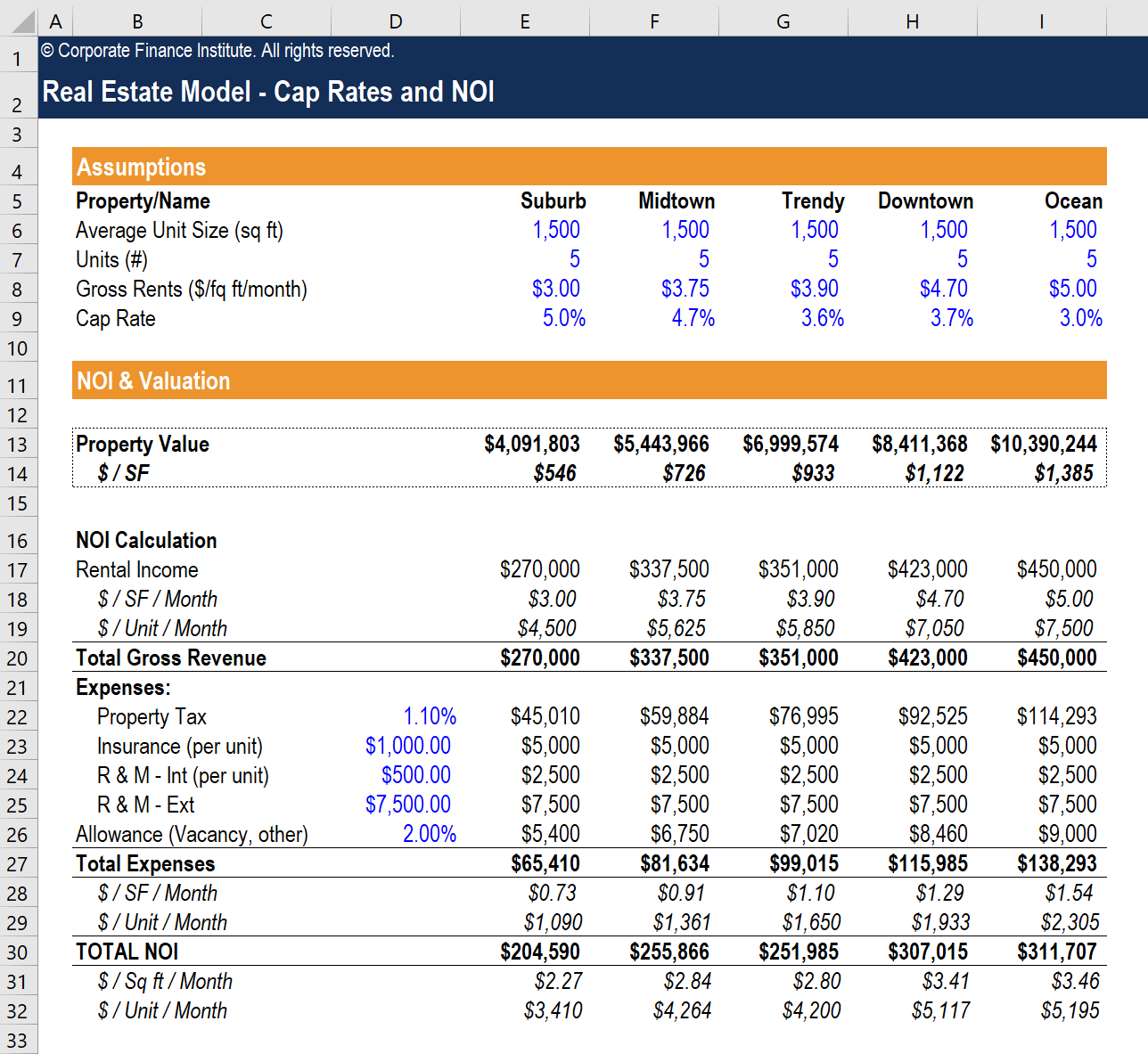

Consider what you'll require to invest in rehabilitations or renovations. Think of what will be required to get the rental market's residential or commercial property prepared. If you need to pay $5,000 to $10,000 for a new HVAC and you're just cash flowing $200 a month, you'll have a difficult time earning any cash off your investment.Cap-rate is the procedure of how rapidly your investment will make its refund and begin producing a revenue revealed as a portion. Purchasers tend to want a greater cap rate, indicating that the purchase rate is low relative to the net operating earnings (NOI ). NOI is a company's earnings after operating costs are subtracted however prior to deducting income taxes and interest. It might suggest the residential or commercial property is in an area where increasing the lease isn't likely, and appreciation is low. Ask about how the cap rate is determined. It's vital to know the tenancy rate, whether expected leas or present leas are being used in the calculation, and the demand for financial best timeshare cancellation company investment homes in the area. A lot cap rate may suggest the residential or commercial property is in an expensive or preferable location. A great cap rate is considered to Learn more be around 10%, although some investors will accept a cap rate as low as 7%. Remember that cap rates also vary by market which the calculations fail to account for appreciation, threat, and opportunity. CCR is just how much money your cash makes you every year revealed as a percentage.

CCR just expresses your initial investment, rather than return on investment( ROI), which thinks about everything your investment involves, including the cost of the financial investment, taxes, repair work, costs, etc. 8 %- 12 %is deemed to be good CCR. However, some investors won't choose anything less than 20%. When you compare CCR to a real estate financial investment trust's( REIT) dividend yields, you can quickly determine if your home deserves the investment. REITs permit you to purchase companies that own or fund rental homes. If you can make as much cash just passively buying REITs, then investing in a property is likely not worth it, offered all the work it takes. You can invest in Class C or D properties, which are more budget friendly because they are less desirable. These are homes that are: At least 30-years old Require considerable rehabilitation They need more upkeep, They are found in older or declining areas with less than ideal school districts and possibly criminal activity, There's a higher risk of turnover and expulsion Lease collection might be tough They tend to value less if at all, They have actually increased CCR due to their cost, Such homes are often found in gateway cities, which are cities that utilized to be considered the gateway to the American dream. Entrance cities have great potential for revitalization since, They generally already have transport facilities, Are typically linked to healthcare facilities, universities, and museums, Are close to cities, They might be qualified opportunity zones, which are designated areas where purchasing the neighborhood and your property earns you tax benefits. Chance zones are designed to encourage revitalization. Investing in real estate to generate passive earnings is among the least complex financial investment techniques. Success in this method needs: Routine upkeep, Composing terrific rental listings, Screening tenants, Occupant appreciation that encourages lease renewals, This strategy is likewise called rehabbing. Ideally, you'll carry out simply enough improvements to increase the value of your rental property. Occupants who appreciate the improvements might consider renewing their lease since of the enhanced living conditions. There are significant differences in between home flipping and rehabbing. House flipping involves buying a home for below market value, rehabbing it just enough to offer it at an earnings, and then duplicating the procedure once the home is sold. A live-in flip is when you reside in your home while the enhancements and repairs are performed and then offer it afterward. The benefit of this financial investment technique is that you might wind up paying no capital gains taxes on a residential or commercial property. The cap is $ 250,000 for single filers and $500,000 for a married couple filing jointly. You had actually to have actually lived in the home can timeshare estates be passed down to heirs for 2 out of the five years before the home sale. If you need to move prior to you complete your live-in flip, there are a couple of reasons you may have the ability to get a partial exclusion from capital gains taxes. Task relocation Change in Health Military deployment Unforeseen circumstances, Wholesaling.

7 Simple Techniques For What Is A Real Estate Investment Trust

is a popular financial investment method for individuals with bad to no credit. Wholesaling is when you discover a lot on a house, created an agreement for it with the seller, and then use what's called an assignment of agreement to transfer the contract to an interested purchaser in exchange for a project fee. In addition to finding buyers and sellers, you require to know how to spot the right property. That indicates: Having the ability to findan excellent candidate for turning. Having the ability to find an excellent candidate for leasing. Estimating the cost of improvements that will include worth to a leasing. Estimating rehabilitation costs. Approximating the costs of significant enhancements( like changing a HEATING AND COOLING). Estimating possible rents, cap rate, cash-on-cash return, and operating expenses. Wholesalers tend to make $ 5,000 or less per deal, although more is possible. It's also possible to practice wholesaling from another location if you have a group assembled. It's an investment strategy that could be particularly effective when there's either a strong buyer's market or a strong seller's market because, in both cases, individuals are hungry for offers.